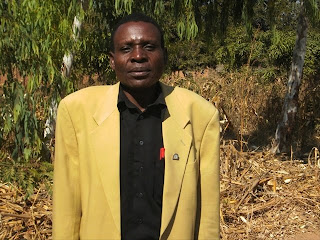

Alec McLean Ngwira has been a member of GSM since 2002. He accepted the responsibility of being the coordinator for the Micro-credit program in 2007. He is a graduate of Lilongwe Teacher College. He is a teacher at the local Secondary School and instructs History, Agriculture, Culture and Chichewa (local vernacular). He has two children and his wife Bettie has received a GSM Micro-credit loan which she used to open a Used Shoes Retail store.

Alec McLean Ngwira has been a member of GSM since 2002. He accepted the responsibility of being the coordinator for the Micro-credit program in 2007. He is a graduate of Lilongwe Teacher College. He is a teacher at the local Secondary School and instructs History, Agriculture, Culture and Chichewa (local vernacular). He has two children and his wife Bettie has received a GSM Micro-credit loan which she used to open a Used Shoes Retail store.

After learning the purpose of GSM Alec decided that, "…I want to help others and improve the status of my family." As the coordinator of the Micro-credit program in Malawi, Alec counsels the loan recipients for accountability and helps scrutinize their plan to assure a higher probability of success. His philosophy is to start small and be thrifty with the loan value. In the small town of Bolero, store fronts are not always necessary to start off a business. So, Alec encourages recipients to focus on profit and loan payback, then grow the business after the first level loan.

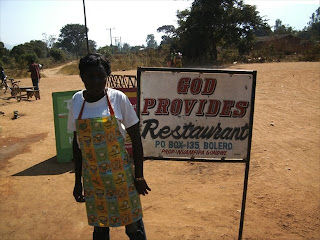

Imelda Gondwe is the proprietress of "God Provides Restaurant". The restaurant serves about 21 meals a day. She has taken three increasing levels of loans from the GSM program and paid them all back on time. On side of the restaurant she has laid a bamboo mat out with a pile of sox. She buys the sox in bulk in the much larger town of Mzuzu and then sells them retail. In the beginning she started merely by baking and selling mandazis (small fried doughnuts) on the street. But anyone can make and sell mandazis, so she recognized the need for specialization, a way to differentiate herself.

Imelda Gondwe is the proprietress of "God Provides Restaurant". The restaurant serves about 21 meals a day. She has taken three increasing levels of loans from the GSM program and paid them all back on time. On side of the restaurant she has laid a bamboo mat out with a pile of sox. She buys the sox in bulk in the much larger town of Mzuzu and then sells them retail. In the beginning she started merely by baking and selling mandazis (small fried doughnuts) on the street. But anyone can make and sell mandazis, so she recognized the need for specialization, a way to differentiate herself.

Her goal has been to educate her three children who are all currently in school. Her oldest daughter desires to get a journalism degree. This will cost about $650 a year, an out-of-reach sum for most in Malawi.

Bettie Ngwira's Mini-shop and Photography Bureau is named "Limbikana" (Work Hard). Three years ago she started selling used shoes on a mat in the center of the small town. Her loan from GSM has helped to purchase a large green stall, about 15' x 8' in size with electricity delivered to it. Her husband Alec has grand plans to next grow the shop into a "communication center" where people will be able to make duplicates on a copy machine, send faxes and someday use the internet. But for now, selling used shoes is the main concern. Her store is open from 8 A.M. (or whenever she gets the children off to school) until 5 P.M.

Bettie Ngwira's Mini-shop and Photography Bureau is named "Limbikana" (Work Hard). Three years ago she started selling used shoes on a mat in the center of the small town. Her loan from GSM has helped to purchase a large green stall, about 15' x 8' in size with electricity delivered to it. Her husband Alec has grand plans to next grow the shop into a "communication center" where people will be able to make duplicates on a copy machine, send faxes and someday use the internet. But for now, selling used shoes is the main concern. Her store is open from 8 A.M. (or whenever she gets the children off to school) until 5 P.M.

One her shop moved from selling on a mat to selling from the stall the products were new clothes and groceries. But there was too much competition in town. So, she decided to specialize in used shoes. Twice a month Bettie or husband goes to Mzuzu to purchase a bale of used shoes. The poor residents of bolero are more apt to buy used shoes than new. It is curious how footware can be a status in a country where so many go barefoot or where simple flip-flop sandals. Bettie sells about 15 pairs of shoes a day. A pair of used Tiva type sandals go for ~$10, dress shoes for about $15 and Timberland type work shoes for ~$25. The inventory which doesn't sell after one month is put out in front of the shop weekly and discounted to ~$1.

Fatia Mzumara is the proud owner of "Textiles and Groceries Mini-shop". From this stall she vends mostly cloth, which is used by women as wrap skirts and baby slings , blankets and other sewing materials. Mostof the colorful material comes from Tanzania because Malawi does not have large manufacturing infrastructure. She keeps a small variety of other unique grocery items. Fatia also has a cooler from which she sells soda. Coke and Fanta Orange are big treats among the populace. 300 ml bottles sell for a controlled price of ~0.30 and is a destination of discretionary spending.

Fatia Mzumara is the proud owner of "Textiles and Groceries Mini-shop". From this stall she vends mostly cloth, which is used by women as wrap skirts and baby slings , blankets and other sewing materials. Mostof the colorful material comes from Tanzania because Malawi does not have large manufacturing infrastructure. She keeps a small variety of other unique grocery items. Fatia also has a cooler from which she sells soda. Coke and Fanta Orange are big treats among the populace. 300 ml bottles sell for a controlled price of ~0.30 and is a destination of discretionary spending.

Fatia's daughter, Chimawembeo, was manning the shop on the morning I visited. Pregnant and unmarried the girl had stopped going to school. Fatia's other two daughters are still in school and they require school fees of $60 each semester (3 semesters per year) for one and $110 per semester for the other. Like most parents, she simply wants a better life for her children and is trying to achieve this through education. Fatia is the chairperson of the GSM Micro-credit Support Committee.

Maria Gondwe is a hard working, industrious seller of dried fish. Twice a month she boards a bus for a 3 hour ride to the Lake. Once there she negotiates hard with the local fisherman for an inventory of Chomba (Talapia-like) and Utaka (large sardine, but from fresh water). While still at the lake she processes the fish by slicing them down the spine and drying in the sun. Then she buys firewood and hires some local boys to help her smoke the fish. After a few days she returns to Bolero where she sells this protein staple for $0,70 for three chomba or seven Utaka.

Maria Gondwe is a hard working, industrious seller of dried fish. Twice a month she boards a bus for a 3 hour ride to the Lake. Once there she negotiates hard with the local fisherman for an inventory of Chomba (Talapia-like) and Utaka (large sardine, but from fresh water). While still at the lake she processes the fish by slicing them down the spine and drying in the sun. Then she buys firewood and hires some local boys to help her smoke the fish. After a few days she returns to Bolero where she sells this protein staple for $0,70 for three chomba or seven Utaka.

Maria is a widow with six children, four of whom are in Primary School. This business has helped her move from a mud/dung hut to a brick home. She is now saving to buy iron sheets to replace her thatched roof. Alec and Rev. Mereka are trying to help Maria find a reliable person whom she can trust to manage her selling table for the 6+ days per month when she goes to the Lake to process the fish. This will give her more selling days and profit. But new entrepreneurs in this environment are reluctant to trust others to care for their business.

Dorothy Msiska does the best job of any borrower to re-pay her loans ahead of schedule. She is a widow, HIV positive and a determined mother of four children (two of whom are in Form 3& 4, equivalent of 11th and 12th grade) and determined that they all attend school. The proceeds from her business help pay for their school fees. Dorothy has a very unique, home made concoction which she sells out every day. There is a commercially available product called "Mahail", but the locals all prefer Dorothy's vitamin drink.

Dorothy Msiska does the best job of any borrower to re-pay her loans ahead of schedule. She is a widow, HIV positive and a determined mother of four children (two of whom are in Form 3& 4, equivalent of 11th and 12th grade) and determined that they all attend school. The proceeds from her business help pay for their school fees. Dorothy has a very unique, home made concoction which she sells out every day. There is a commercially available product called "Mahail", but the locals all prefer Dorothy's vitamin drink.

The drink is called Chindongwa (liquefied gruel in consistency) and is made from millet, maize flour and water. The secret of preparation is in Dorothy's hands. Commercial Mahail uses sugar to release the aminos and nutrients in the millet. Dorothy's does not. The locals love it and she sells all she can make each day. Her daily batch consists of about 30 1-litre bottles sold for ~$0,35 and 40 300 ml bottles sold for $0.18. Early in the morning she delivers the full bottles to her regular customers and sells the rest in the village market. In the evening she returns to collect the bottles to wash them and prepare for filling the next morning.

In a country where nutrition is greatly lacking, for some of the people who buy Dorothy's Chindongwa, it may be their only meal of the day. Since she sells all that she can make. So, we are encouraging Dorothy to double her business and begin selling her product in neighboring towns. She is not yet ready for that challenge but clearly has a winning business.

Annie Sekani Ngwira previously owned a restaurant for 15 years. She decided to change her focus to retailing, with a specialty of used sheets and children's T-shirts. Used sheets move well because most people either don't have the funds to buy new ones or are afraid to make such a large expenditure on what is considered a luxury item. On the day I visited, one of her younger daughters (six children in all) was away at another village for their local market day with several bags of T-shirts. The children's T-shirts are relatively inexpensive (<$1.00) so they tend to sell quite briskly.

Annie Sekani Ngwira previously owned a restaurant for 15 years. She decided to change her focus to retailing, with a specialty of used sheets and children's T-shirts. Used sheets move well because most people either don't have the funds to buy new ones or are afraid to make such a large expenditure on what is considered a luxury item. On the day I visited, one of her younger daughters (six children in all) was away at another village for their local market day with several bags of T-shirts. The children's T-shirts are relatively inexpensive (<$1.00) so they tend to sell quite briskly.

Annie is fortunate to have a working husband who also sells dried fish in town, along side Maria Gondwe. Every day Annie sets up her products on poles and ropes for potential buyers to see and takes them down again, carrying to her home at night. The biggest revenue days come when she returns from Mzuzu or occasionally the capital city of Lilongwe with a new bale of used cloth and clothing. People quickly dive through the mound of cotton searching out bargains.

Margie Gondwe is the Vice Chairman of the Micro-credit support group. She is also on the Praise Team at her church. The front rafter of her stall reads, "CHIUTA NIMUWEME VIRI MUNTHAZI". Translated this means, "God is Good, Good Things are Yet to Come". She only has one child, but cares for another orphan in her home. Margie had this business started before she came to GSM for a loan and is using the money to boost up her inventory and sales. Her store mostly concentrates on selling clothing, particularly men's trousers. A recent phenomenom in Africa and a very good seller are wheeled suitcases. In a country where most goods are transported on the heads of women, a wheeled suitcase is quickly becoming a hot item (although it is still not uncommon to see women carrying the suitcase on the head).

Margie Gondwe is the Vice Chairman of the Micro-credit support group. She is also on the Praise Team at her church. The front rafter of her stall reads, "CHIUTA NIMUWEME VIRI MUNTHAZI". Translated this means, "God is Good, Good Things are Yet to Come". She only has one child, but cares for another orphan in her home. Margie had this business started before she came to GSM for a loan and is using the money to boost up her inventory and sales. Her store mostly concentrates on selling clothing, particularly men's trousers. A recent phenomenom in Africa and a very good seller are wheeled suitcases. In a country where most goods are transported on the heads of women, a wheeled suitcase is quickly becoming a hot item (although it is still not uncommon to see women carrying the suitcase on the head).

Dorisa Mhango runs the most popular restaurant in town. It is named "Jenet Restaurant" after one of her three daughters. It is so successful that she is able to employ two waitresses and a cook. She probably sells more soda in town than any other establishment, so the Coca-Cola Bottler has installed one of their large deep chest coolers in her establishment. On a good day they sell about 16 crates of soda (20 each equals 320 bottles) and never sell less than 6 crates per day.

Dorisa Mhango runs the most popular restaurant in town. It is named "Jenet Restaurant" after one of her three daughters. It is so successful that she is able to employ two waitresses and a cook. She probably sells more soda in town than any other establishment, so the Coca-Cola Bottler has installed one of their large deep chest coolers in her establishment. On a good day they sell about 16 crates of soda (20 each equals 320 bottles) and never sell less than 6 crates per day.

Last time I visited back in February I asked to see a menu, but was told they didn't have one. Why should they need one when the fare consisted of only chicken and beef for meat and rice, nshima or chips for carbs, any combination accompanied by boiled greens. But Alec informed that the day after I first visited they asked him to make and print a menu. Sure enough hanging on opposite walls was a menu with each possible combination of protein, starch and vegetable…not costing more than $2.00. Serving about 70 meals a day, Jenet Restaurant is responsive to their customers.